Start your dream project?

We have a TEAM to get you there.How to create a payment gateway for your businesses?

How does a payment gateway help your business and what benefits it will add to your business?

How much does it cost to build a payment gateway for your business?

If you have landed on this blog, probably these are the most common questions running through your mind… Don’t worry we have answers to your questions in this blog…

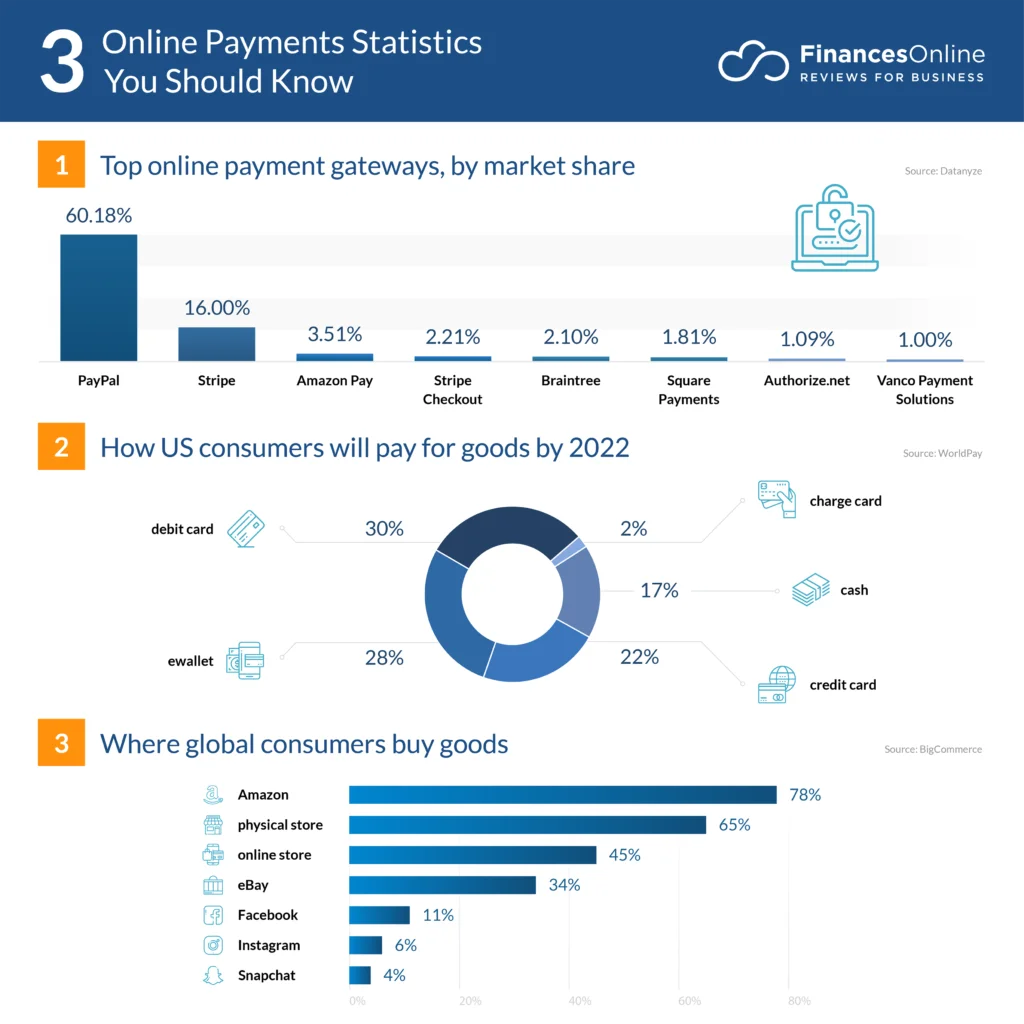

Payment gateways are witnessing a significant rise in popularity among businesses due to the exponential growth of digital payments.

In 2020, the global digital payments market was valued at $4.4 trillion and is projected to reach a staggering $14.78 trillion by 2027, with a compound annual growth rate (CAGR) of 11.80%.

This surge in digital payments is driving businesses to adopt payment gateways as a seamless and secure means to facilitate transactions.

But the central question is what exactly pushing the adoption rate of payment gateways?

With the global impact of Covid-19 and the sudden rise in the e-commerce market, customers’ psychology of making payments have shifted from traditional payment methods to digital payments.

Covid-19 has majorly forced people to use multiple-payment gateways to make cashless payments and ultimately this scenario drives an immediate increase in payment gateway adoption.

According to recent studies, 87% of consumers prefer to make digital payments, with 43% of consumers using digital wallets and 33% using credit cards for online purchases.

Image Source: financesonline.com

This shift in consumer behavior is pushing businesses to offer convenient and secure digital payment options, which payment gateways can provide.

On the other side of the story, payment gateways offer businesses the ability to accept payments from multiple sources, including credit cards, debit cards, e-wallets, and cryptocurrencies. This diverse payment acceptance capability enables businesses to cater to a wider customer base and tap into new markets, both locally and globally, driving revenue growth.

So after knowing these market figures, your first question must be “How to create a payment gateway?” well many people think that it’s all need to hire a mobile app developer in India to kickstart your project. But before that, there are many things that you need to understand…

Let’s get to know the process of developing a Payment Gateway in detail…

How To Create a Payment Gateway?

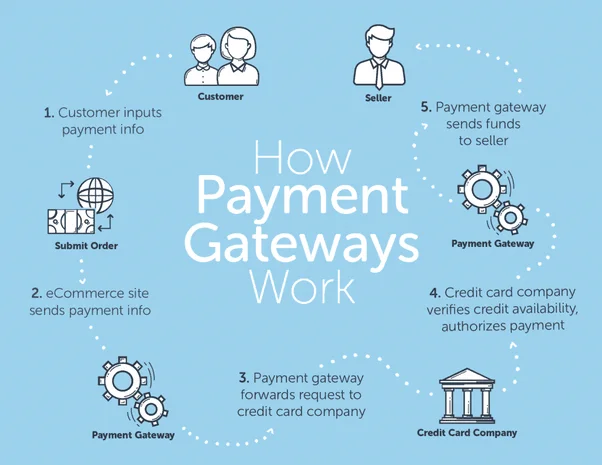

Creating a payment gateway can be a complex process that requires a deep knowledge of programming languages, security protocols, and financial regulations. But before that what exactly is a payment gateway and how does it work?

However, if you are up for the challenge, here is a snapshot of a step-by-step guide to help you understand how to create a payment gateway in a few simple steps:

Step 1: Understand Your Objectives

Surely you will be impressed with the statistics and may be curious to get started on the payment gateway process. But, before you start building your payment gateway, you need to define the requirements. Determine what kind of payments you will accept, which currencies you will support, and what security measures you will implement. Once you know the requirements, you can jump on building the product by deciding upon the programming languages.

Step 2: Choose a Programming Language

Select a programming language that is best suited to your needs. The common and trusted choice of programming languages that you can choose to build a payment gateway is Python, Java, and PHP. The best part is, you can easily hire a PHP developer in India who can help you create a secure payment gateway.

Step 3: Select a Reliable Payment Processor

Choose a payment processor that will handle the financial transactions for your payment gateway. Popular payment processors include PayPal, Stripe, and Authorize.Net.

Step 4: Develop the Payment Gateway

Develop the payment gateway using the programming language you have chosen. Make sure that the payment gateway should keep the payment information secure between the merchant and the payment processor and conduct seamless payment transfers.

Step 5: Integrate with the Payment Processor

Integrate your payment gateway with the payment processor you have chosen. This will involve configuring the API and ensuring that the payment processor can securely receive payment information from your gateway.

Step 6: Implement Security Measures

To keep the frauds at bay, it is important to implement security measures to protect your payment gateway and the sensitive information of your customers. As it is one of the most critical parts of creating a payment gateway, therefore it makes sense to hire a full-stack app developer in India to make it done rightly. To enhance the security of your payment gateway, you can use various security measures such as SSL encryption, implementing two-factor authentication, and monitoring for suspicious activity.

Step 7: Test the Payment Gateway

Before you launch a payment integration in your business module, it is important to test your payment gateway to ensure that it is working properly. For rigorous testing, you can ask developers to conduct both manual and automated testing for common errors, such as invalid credit card information or declining payment transactions.

Step 8: Launch and Monitor the Payment Gateway

Once you have tested your payment gateway and implemented all necessary security measures, you can launch your payment gateway. To make it run flawlessly in the long run you need to monitor your payment gateway for any issues and maintain it regularly to ensure that it continues to function properly.

So with these steps, you have learned how to create a payment gateway for your business. But while investing a huge amount of money and effort into this process, you must be curious to know how creating a payment gateway can benefit your business.

How Can Payment Gateway Benefit Your Business?

In this digital era, adopting to integrate a payment gateway into your business actually a modern bridging a gap between customers and businesses. The way people are turning to digital payments, it has become necessary for businesses to consider developing a payment gateway to streaming their payment process.

So now you know that how to create a payment gateway but how creating a payment gateway can benefit your business?

But before that you need to know how does it work?

Image Source: medium.com

Here are some ways digital payment gateways can benefit your business:

- Control Over Payment Process: By creating your payment gateway, you can have complete control over the payment process. You can customize the payment gateway according to your specific business needs, ensuring that your payment process is efficient, secure, and tailored to your customer’s preferences.

- Reduced Transaction Fees: Third-party payment gateways often charge transaction fees for each payment processed. By creating your payment gateway, you can reduce or eliminate these fees, and save your business from paying large amounts of transaction fees over thousands of transactions. On a custom payment gateway, you just need to hire a dedicated app development team in India and make a one-time investment.

- Enhance Customer Experience: In today’s digital age, customers demand a seamless and hassle-free payment experience. Integrating a payment gateway can help you offer a smooth checkout process, which will improve the overall customer experience and satisfaction. By providing a variety of payment options, such as credit cards, debit cards, e-wallets, and net banking, you can cater to the diverse needs and preferences of your customers.

- Integration with Other Business Systems: The biggest benefit of developing a payment gateway is it be integrated with other business systems, such as accounting software or inventory management systems. To make it work, you can consider hiring an app developer in India who is an expert in creating payment gateway.

- Increased Sales: Accepting online payments through a payment gateway can expand your customer base beyond geographical boundaries, increasing your reach and visibility. With more customers, you can expect an increase in sales and revenue. In addition, you can also benefit from impulse buying, where customers are more likely to make a purchase when the checkout process is fast and seamless.

Looking for ways to increase your business sales? Read more about the 122+ top mobile app development trends that can help you make money in 2023.

These are the few top benefits of creating a payment gateway for your business, but what problems and challenges can be overcome by developing a payment gateway…Apart from learning how to create a payment gateway, you need to understand how it can help you address the payment processing challenges…

Who Needs a Custom Payment Gateway App?

Here are the types of companies that could greatly gain from creating their own customized payment gateway:

- Big Retailers with Frequent Transactions: Think of large stores that process a lot of transactions. They’d benefit by having their own system instead of relying on an external company.

- Existing Billing Services Looking for an Upgrade: Companies already in the billing industry might want to modernize their software or swap it out for something better.

- Fast-Growing Payment Providers: These are the up-and-coming payment services that need a more advanced way to handle payments as they expand.

- IT Businesses Branching into Payments: IT companies looking to step into the payment world can use a tailored gateway to become a payment service provider.

- Banks Wanting Better Front-End Solutions: Banks that handle acquiring (collecting payments from merchants) could enhance their services with a more improved front-end setup.

So, if you’re any of these, planning to create a custom payment gateway then you need to learn the cost to hire app developers in India.

Also Read: How Much Does It Cost to Build Buy Now Pay Later App?

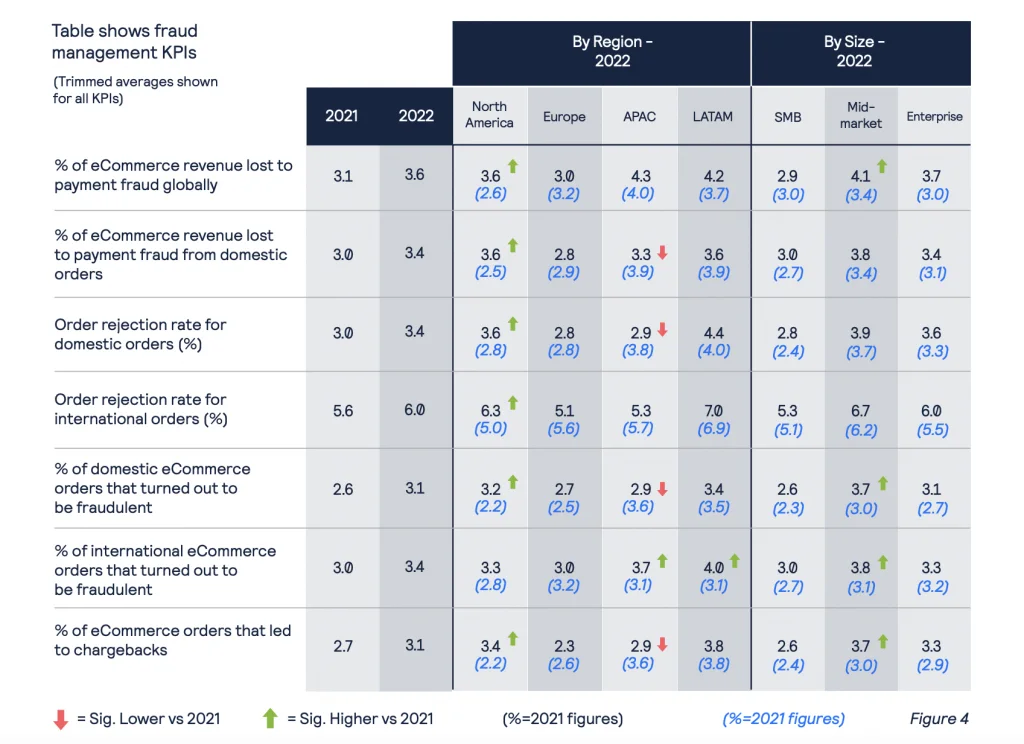

Solutions to the Biggest Challenge of Creating a Payment Gateway – Fraud Detection and Security Enhancement

How many of you believe that a payment gateway is a potential solution to all such payment processing challenges like fraud, security breaches, lack of monitoring, and more…

Those who have recently switched from traditional business models to digital payments may find it hard to believe that creating a payment gateway can increase security and minimize the risk of fraud…

But you don’t have to trust our words. Here we have valid stats and facts that help you understand how creating a payment gateway can benefit your business and enables you to offer a secure payment processing environment.

- According to a report by Nilson, a global payment industry researcher, the total worldwide fraud losses from payment cards, including credit, debit, and prepaid cards, have jumped from $25.53 billion in 2019 to $25.27 billion in 2020. In fact, global brand cards accounted for 88.43% of all card losses to fraud globally in 2020.

But after the outbreak of Covid-19, there is a sudden rise in digital payments and businesses have fastly invested in Payment gateways. And if you noticed the below graph, you’ll find a slight dip in card fraud worldwide.

Image Source: nilsonreport.com

- Payment gateways use advanced encryption and tokenization techniques to protect sensitive customer data, such as credit card information, from theft or fraud. To make it work you can hire Indian mobile app developers that enable you to build strong encryption such as two-factor authentication, which requires users to provide two forms of identification to access their accounts, and address verification systems, which verify the billing address of the customer’s credit card.

- A survey conducted by CyberSource, a leading global payment management company, found that businesses from different domains that have implemented advanced fraud management tools, such as fraud detection and prevention services offered by payment gateways, experienced lower fraud rates and higher revenue growth compared to those that did not.

Image Source: cybersource.com

With these valid facts and stats, you have got an idea that how implementing a payment gateway can help you get a solution to security issues. But the central question is what things to keep in mind if you decide to create a payment gateway…

Understanding the Types of Payment Gateways for Your Business

Before you hire a software developer in India, you need to understand what type of payment gateway you need to develop.

In general, payment gateways are third-party services that facilitate online transactions between a merchant and a customer. They provide a secure connection between the buyer, seller, and the payment processor, allowing payments to be made electronically via credit card, debit card, or other payment methods.

Though there are various types of payments gateways available to adopt they can be broadly categorized as follow:

– Hosted Payment Gateways:

In a hosted payment gateway, the customer is redirected to the payment gateway’s website to complete the payment process. The customer enters their payment details on the payment gateway’s secure page, and the transaction is processed.

Examples of hosted payment gateways include PayPal and Stripe.

– Self-hosted Payment Gateways:

A self-hosted payment gateway allows the customer to enter their payment details directly on the merchant’s website. The payment gateway is integrated into the merchant’s website, and the payment process is completed without the customer leaving the website.

Examples of self-hosted payment gateways include Authorize.Net and Braintree.

– Mobile Payment Gateways:

Mobile payment gateways are payment solutions that allow customers to make payments using their mobile devices.

Examples of mobile payment gateways include Apple Pay, Google Wallet, and Samsung Pay.

No matter what type of payment gateway you decide to build for your business, make sure it has all the essential features to seamlessly meet the needs of customers…

To build a feature rich payment gateway app, you need to hire full-stack developer in India. Read more to know the USPs of hiring software developer in India from AppsDevPro.

What Features Do You Need To Look For In Payment Gateway and Its Cost?

When choosing a payment gateway for your business, there are several key features that you should consider to ensure that it meets your needs. These features include:

Security: Security is paramount when it comes to payment gateways. You should look for a payment gateway that uses SSL encryption, has fraud detection measures in place, and is PCI compliant.

Payment methods: When looking for the answer that how to create a payment gateway, make sure you keep in mind that your payment gateway should support the payment methods that your customers prefer. This may include credit and debit cards, e-wallets, and bank transfers.

Integration: Your payment gateway should be easy to integrate with your website or e-commerce platform. Look for payment gateways that offer APIs or plugins for easy integration.

User experience: A good payment gateway should offer a smooth and seamless user experience for your customers. This means a streamlined checkout process and clear instructions for completing payments.

Customer support: Look for a payment gateway that offers reliable customer support, preferably with 24/7 availability.

As for the estimated cost, it can vary depending on the payment gateway provider and the specific features you require. Most payment gateways charge a fee per transaction, typically ranging from 1% to 3%. Some payment gateways also charge a monthly or annual fee, while others offer their services for free but take a higher percentage of each transaction. Some payment gateway providers also offer customized pricing plans based on the size and needs of your business.

Overall, the cost of a payment gateway will depend on the specific features consider integrating and the volume of transactions your business processes. It’s important to research and compares different payment gateway providers to find the one that best meets your needs and budget.

How Much Does It Cost To Build a Payment Gateway App?

Creating a payment gateway app involves a variety of factors that influence the overall cost. The cost can vary widely based on the complexity of the app, the features you want to include, the technology stack you choose, and the development resources you employ. Here’s a breakdown of the costs based on different levels of complexity:

– Basic Payment Gateway Integration (Low Complexity):

If you’re looking to integrate a basic payment gateway into an existing app, the cost can range from $10,000 to $15,000. This includes integrating a standard payment API, setting up basic payment processing, and ensuring security measures for handling transactions.

– Custom Payment Gateway App (Medium Complexity)

For a standalone payment gateway app with a user-friendly interface and additional features like payment history, multiple payment methods, and simple analytics, you’re likely looking at a cost between $15,000 and $20,000. This includes designing a user interface, integrating various payment methods, and incorporating basic reporting features.

– Advanced Payment Gateway Solution (High Complexity)

If you’re aiming for a comprehensive payment gateway app with advanced features like subscription management, multi-currency support, fraud detection, mobile wallets, and more, the cost could range from $20,000 to $30,000 or more. This level of complexity demands significant development time, thorough testing, and ongoing maintenance.

– Enterprise-Level Payment Gateway System (Very High Complexity)

For large-scale enterprises requiring a highly secure, customizable, and scalable payment gateway platform, the cost can exceed $50,000+. This involves extensive development, robust security measures, compliance with industry standards, and potentially integrating with other complex systems.

Read also: Hire full-stack app developer in India to build complex enterprise app.

Factors that can influence the cost of creating a payment gateway app:

Any payment gateway app can cost between $10,000 to $25,000+ and more. But you what factors can affect the app development cost? So if you are looking for the simple ways to calculate the app development cost then you need to

- Design Complexity: The more intricate and visually appealing the user interface, the higher the design costs.

- Integration: Integrating various payment methods, APIs, and third-party services adds to the development time and complexity.

- Security Requirements: Ensuring high-level security through encryption, PCI compliance, and fraud prevention mechanisms increases development time and thus costs.

- App Testing: Rigorous testing for reliability, security, and compatibility across devices and platforms is crucial and contributes to the overall cost.

- Platform and Technology: The choice of platform (iOS, Android, web) and technology stack (programming languages, frameworks) can impact development time and costs.

- Regulatory Compliance: If your app deals with financial transactions, adhering to financial regulations might require additional development effort.

- Support and Maintenance: Ongoing updates, bug fixes, and customer support are ongoing costs that need to be considered.

Remember that these estimates are rough ranges and can vary based on many variables. It’s advisable to consult with professional app development agencies or freelancers to get a more accurate estimate based on your specific requirements.

Conclusion: How Can AppsDevPro Help You Create a Payment Gateway For Your Business?

With this blog guide, you may have got an idea that how to create a payment gateway and how online payment methods are taking over the traditional procedures. So if you are made a decision to hire an app developer in India, then AppsDevPro can be your ultimate place.

AppsDevPro is the perfect solution for businesses looking to create a payment gateway. With their expertise in app development and payment processing, they can help you create a seamless payment experience for your customers. Whether you need a custom payment gateway solution or want to integrate with an existing payment processor, AppsDevPro has the experience and knowledge to make it happen.

With their team of experienced developers, they can provide a comprehensive solution that meets your specific needs. So, if you’re looking for a reliable payment gateway solution for your business and its real estimations, then you can contact us or drop your query here.

FAQs

What technology is used to create a payment gateway?

Payment gateway technology is typically built using a combination of programming languages such as Java, C++, and .NET. It also involves integrating with various payment processing networks, such as Visa, Mastercard, and PayPal.

What kind of security measures should be implemented in a payment gateway?

A payment gateway should implement multiple security measures to ensure the protection of sensitive customer data, including SSL/TLS encryption, tokenization, and two-factor authentication. It’s also essential to comply with industry-standard security protocols such as PCI DSS.

What are the steps involved in integrating a payment gateway with an eCommerce platform?

The integration process can vary depending on the eCommerce platform and the payment gateway used. However, it typically involves creating an account with the payment gateway provider, obtaining API credentials, and then configuring the payment gateway plugin on the eCommerce platform.

Can a business create its payment gateway, or is it better to use a third-party provider?

While it’s possible to create a custom payment gateway, it can be a complex and costly undertaking, requiring significant technical expertise. For most businesses, it’s more efficient to use a third-party provider that offers pre-built solutions that can be integrated into their existing systems.

How long does it take to create a payment gateway from scratch?

Developing a custom payment gateway can take several months to a year, depending on the complexity of the system, the number of integrations required, and the resources available. It’s important to factor in development, testing, and deployment phases to estimate the timeline accurately.

You can also check our other services:

Hire Mobile App Developers in India, Hire Xamarin App Developer in India, Hire iPhone App Developers in India, Hire Android App Developers in India, Hire Flutter App Developer in India, Hire React Native Developers in India, Hire Kotlin Developer in India, Hire Web Developer in India, Hire PHP Developer in India, Hire Laravel Developer in India, Hire Nodejs Developer in India, Hire Microsoft Developer, Hire ASP.NET Developer in India, Hire Angular.js Developer in India, Hire React.js Developer, Hire E-commerce Developer in India, Hire Magento Developer in India, Hire WordPress Developer, Hire AI Developers in India, Hire Java Developers in India, Hire Python Developers in India, Hire Javascript Developer in India, Hire AR/VR Developers in India, Hire Blockchain Developers in India